Claim your part of the billions of dollars offered each year in government tax incentives for businesses.

*Even if you're not profitable yet!

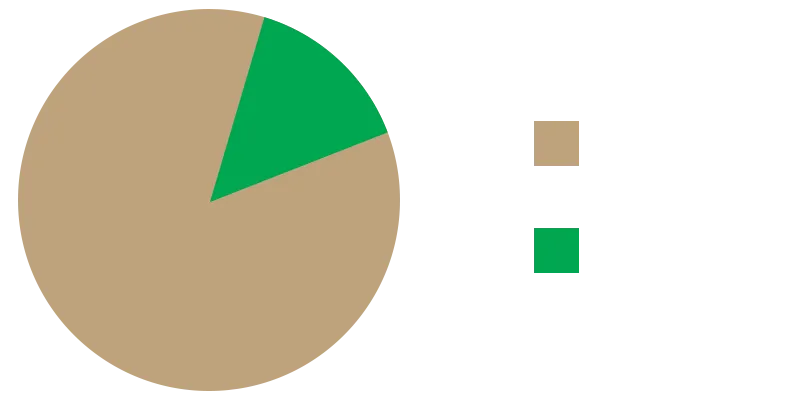

Only $15 Billion out of the total $100 Billion available was claimed last year.

Did You Get Your

Tax Credits?

No industry or business type is excluded, although by the nature of their activities, some are more qualified than others.

Claiming the R&D tax credit can be complicated and tedious, but we make it easy – handling the whole process so you can skip the paperwork and get back to business.

As Seen On

What is the R&D Tax Credit?

The Research and Development (R&D) Tax Credit remains one of the best opportunities for businesses to substantially reduce their tax liability. For what amounts to their daily activities, companies from a wide range of industries can qualify for federal and state tax savings high enough to allow companies to hire new employees, invest in new products and grow operations. Now, due to recent modifications and expansions over the years, more companies than ever before can benefit from this valuable incentive.

Tax Credit Highlights

✓ Increased Cash Flow: Unlock additional capital that can be reinvested into your business.

✓ Dollar-for-Dollar Tax Reduction: Benefit from federal and, in some instances, state tax reductions that directly lower your income tax.

✓ Retroactive Claims: You can claim credits for open tax years going back 3-4 years, providing an immediate financial boost.

✓ Reduced Tax Rate: Lower your overall tax rate, enabling greater profitability in the long run.

Only $15 Billion out of the total $100 Billion available was claimed last year, leaving most on the table.

Our combination of software and experts make the R&D claim process simply and your paperwork meticulous. We also ensure your payroll provider, tax preparers, and accountants are all on the same page.

Your Partner in R&D Tax Credits

As a leader in research and development tax incentives, Tax Prep Advocates recognizes that the steps you take today can impact the outcome of current and upcoming audits. Our licensed, experienced tax experts consult with our CPA partners and clients, serving as an extension of your team.

Not only can our tax professionals identify R&D tax credit opportunities, but we'll also develop a customized analysis and documentation approach to maintain your eligibility for program participation.

Which Activities Qualify for R&D Tax Credits?

Creating improved products, processes, formulas, software, and techniques

Automating or improving internal manufacturing processes

Designing tools, jigs, fixtures, and molds

Integrating new equipment

Network hardware and software development and optimization

Mobile application development

Internet of Things (IoT) development

Development of data center, big data, and data mining tools

Integration of APIs and other technologies

Manufacturing new or improved products

Developing prototypes, first articles, models

Evaluation of alternative materials

Development of firmware

Network hardware and software development and optimization

Developing simulators

All-in-one support

With tax prep advocates you get bookkeeping, tax return accounting, and R&D credit support all under one roof. We already know your numbers from the ground up. That means we work fast and efficiently to identify expenses and maximize your savings.

Here’s how we streamline the entire process:

We conduct an R&D tax study, which identifies the total amount of qualifying R&D expenses you can claim on its federal tax return.

We prepare and file the necessary tax paperwork to claim the R&D credit, we provide the right documentation for your tax preparer to file.

We provide required supporting documentation,

which is an important prerequisite in case of an IRS audit.

End-to-end service

We handle the full R&D tax claim process for you. That includes identifying eligible R&D expenses, filing the right paperwork, and making sure your credit is accurately applied through your payroll.

You could save thousands through the R&D credit, so it’s important it’s done right. We handle the tax claims process from start to finish and provide the necessary documentation to back up your claim with the IRS.

*Are you a new business or not profitable yet?

Your company may be able to apply the R&D tax credit against payroll tax if the following are true:

You’ve never had gross receipts or only had them within the last five years

You have less than $5 million in gross receipts during the current year

You have qualifying research activities and expenditures that meet the IRC Sec. 41 four-part test

You have payroll-tax liability

You can potentially offset up to $500,000 in R&D credits to use against your payroll tax each year, for up to five years when you file the credit "on-time" meaning it is not an amended return.

Reach out to us today, and let's explore how R&D tax credits can drive innovation and growth for your business.

Frequently asked questions

Do I qualify for R&D tax credits?

For Startup Companies: If your business has less than $5 million in annual revenue, and it's been less than five (5) years since your first gross receipts/sales, you can frequently reduce your Social Security Payroll tax liability under the PATH Act R&D credit. If you do not qualify under the PATH Act R&D Credit, you can take regular R&D Credit against income taxes (rather than against payroll taxes).

*Can a startup or newer company claim R&D Tax Credits even if they're not profitable?

YES! a common misconception with research and development (“R&D”) tax credits is that you must be in a profitable tax position to utilize the R&D tax credits. This was the case prior to January 1st, 2016 or before the tax credit was permanently extended as a part of the PATH Act of 2015. However, the IRS provided guidance as part of Notice 2017-23 that describes how qualified small businesses (start-ups) can offset up to $250,000 of the employer portion of payroll tax liability (social security tax) for the eligible tax year. Eligibility - Your business must have less than $5 million in gross receipts in the current tax year and your business must not have gross receipts from more than five years ago. This applies to an "on-time" filing, meaning it's not an amended return.

What activities qualify for R&D tax credit?

Qualifying R&D expenses and/or activities are those which pass this four-part test:

Technical uncertainty. The activity is performed to eliminate technical uncertainty about the development or improvement of a product or process, which includes computer software, techniques, formulas, and inventions.

Process of experimentation. The activities include some process of experimentation undertaken to eliminate or resolve a technical uncertainty. This process involves an evaluation of alternative solutions or approaches and is performed through modeling, simulation, systematic trial and error, or other methods.

Technological in nature. The process of experimentation relies on the hard sciences, such as engineering, physics, chemistry, biology, or computer science.

Qualified purpose. The purpose of the activity must be to create a new or improved product or process, including computer software, that results in increased performance, function, reliability, or quality.

How large will my R&D tax credit be?

Unlimited, if applying the R&D credit against income taxes. These credits can range between 5% and 15% of qualifying R&D costs. If taking the PATH Act R&D credit, a company can receive up to $500k* against payroll taxes and take the remainder against income taxes.

As an example, for an unprofitable 5-person tech startup that has less than $5M in annual revenue with roughly 80% of time being spent on qualifying R&D activities, and average salary of $100k/year, the credit might be between $20k to $60k. Tax Prep Advocates’ fee is a small percentage of the total qualifying R&D expense and easily pays for itself by securing the R&D Tax Credit for you.

*$500,000 for 2023 tax year, $250,000 for 2022 tax year

Can I claim the R&D credit retroactively?

Yes, we can help you file an amended tax return to claim the R&D credit for previously filed Income Tax returns (past 3 years), but you cannot take the PATH Act R&D credit on an amended tax return.

Does Tax Prep Advocates support you in case of an audit?

Yes, we offer unlimited Audit Support. In the case of an audit, we would provide audit assistance, free of charge with your study. This includes direct discussions with our R&D tax credit experts who will advise you every step of the way and help you navigate the complex Internal Revenue Code in order to defend the credits you have generated.

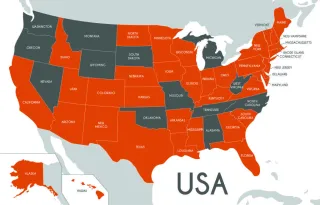

Are there state-level R&D tax credits?

Most states currently offer an R&D credit. Generally, the states follow federal guidelines on what constitutes qualified R&D expenditures with few exceptions. Tax Prep Advocates will provide guidance on state level credits. For example, the CA R&D credit is non-refundable which means it cannot be taken against payroll tax. Work must be done in CA to be considered qualified and CA credits can carry forward indefinitely until exhausted.

Why is having an R&D study done important?

Tax Prep Advocates recommends anyone who claims the R&D credit to get a study done. An R&D study determines the total amount the business should claim and collects the necessary documentation to support that claim.

When filing for the R&D tax credit, you must submit the relevant tax forms to the IRS. However, you must also have the technical and financial justification of what you were claiming prepared in case the IRS audits your claim. If the IRS audits the claim and you can’t produce technical and financial evidence behind what you claimed, you will need to return the money and potentially pay a penalty.

Can I use Tax Prep Advocates R&D Credit Service without using your Tax Preparation?

Yes, we’ll calculate the R&D tax credits and provide the necessary documentation & full instructions for your tax preparer to file. If you use Tax Prep Advocates, we’ll take care of the full process and file the necessary tax paperwork on your behalf as well.

What does Tax Prep Advocates' R&D Credit Service include?

We help businesses with all aspects of claiming these R&D Tax Credits. Tax Prep Advocates will:

✓ Identify and calculate qualifying R&D expenses.

✓ Prepare Forms 6765 and/or 8974. If you use Tax Prep Advocates, we’ll file on your behalf as well.

✓ Prepare all required supporting technical and financial documentation, including documentation of research time, R&D payroll expenses, etc. This is an important pre-requisite to support an IRS audit in case that happens.

✓ Coordinate with your tax preparer, payroll provider, and accountant to ensure your books and taxes are accurate.

✓ Continually ensure the credit is applied correctly against your payroll liabilities.

✓ Email and phone support with R&D credit experts.

Are there any Guarantees?

Yes. We have an Accurate Calculation Guarantee. We guarantee every calculation up to $1M against any errors in your study.

Tax Prep Advocates is a provider of back-office services, including bookkeeping, controller services, and CFO services. Tax Prep Advocates is not a public accounting firm and does not provide services that would require a license to practice public accountancy.

©2025 Tax Prep Advocates Inc.